This company has no active jobs

0 Review

Rate This Company ( No reviews yet )

About Us

Understanding Gold IRAs: A Complete Information to Investing In Precious Metals

Within the ever-evolving landscape of retirement planning, Gold IRAs have emerged as an more and more well-liked option for investors trying to diversify their portfolios and protect their wealth in opposition to financial uncertainties. A Gold IRA, or Individual Retirement Account, permits people to spend money on physical gold and other precious metals as a part of their retirement financial savings technique. This text will delve into the intricacies of Gold IRAs, their advantages, the strategy of setting one up, and the current trends available in the market.

What is a Gold IRA?

A Gold IRA is a particular type of self-directed individual retirement account that permits the inclusion of physical gold, silver, platinum, and palladium as funding choices. In contrast to traditional IRAs, which sometimes hold paper property such as stocks and bonds, a Gold IRA allows for tangible assets that can provide a hedge in opposition to inflation and financial downturns.

The interior Revenue Service (IRS) has established particular tips regarding the sorts of valuable metals that can be included in a Gold IRA. These metals should meet sure purity standards and be produced by authorised mints. As an illustration, American Gold Eagles, Canadian Gold Maple Leafs, and sure bars from recognized refiners are eligible for inclusion in a Gold IRA.

Advantages of Gold IRAs

- Inflation Hedge: Gold has traditionally been viewed as a secure haven during periods of inflation. As the purchasing power of fiat currencies declines, the value of gold tends to rise, making it a lovely choice for preserving wealth.

- Portfolio Diversification: Including gold in a retirement portfolio may help scale back general danger. Precious metals typically have a low correlation with traditional asset courses, that means that they might perform well when stocks and bonds are underperforming.

- Safety Against Economic Instability: In instances of financial uncertainty, geopolitical tensions, or financial crises, gold usually retains its worth higher than different investments. This characteristic makes it a dependable asset for lengthy-time period investors seeking to safeguard their retirement savings.

- Tax Advantages: Like other IRAs, Gold IRAs provide tax-deferred growth. Which means that traders do not pay taxes on the earnings from their gold investments until they withdraw funds from their account throughout retirement.

The way to Set up a Gold IRA

Establishing a Gold IRA includes several key steps:

- Select a Custodian: The first step is to select a reputable custodian who makes a speciality of Gold IRAs. Custodians are chargeable for managing the account, guaranteeing compliance with IRS regulations, and facilitating transactions. It is crucial to choose a custodian with a stable monitor file and optimistic buyer critiques.

- Open an Account: Once a custodian is selected, the investor will need to finish the required paperwork to open a Gold IRA. This course of typically entails offering personal info, deciding on the kind of IRA (traditional or Roth), and funding the account.

- Fund the Account: Investors can fund their Gold IRA via varied means, together with rolling over funds from an present retirement account, making a direct contribution, or transferring assets from one other IRA. It is important to know the IRS guidelines relating to rollovers to keep away from tax penalties.

- Choose Valuable Metals: After funding the account, buyers can select which precious metals to buy. The custodian will information the investor in choosing IRS-authorized metals that meet the required purity standards.

- Storage Solutions: Physical gold should be saved in an accredited depository to adjust to IRS laws. Buyers can select between segregated storage, the place their metals are stored individually from others, or commingled storage, the place metals are stored collectively. If you loved this short article and you wish to receive more information regarding gold ira investment generously visit the website. The selection often depends on private preferences and cost issues.

Present Traits in Gold IRA Investments

As of 2023, the demand for Gold IRAs has seen vital progress, pushed by various components:

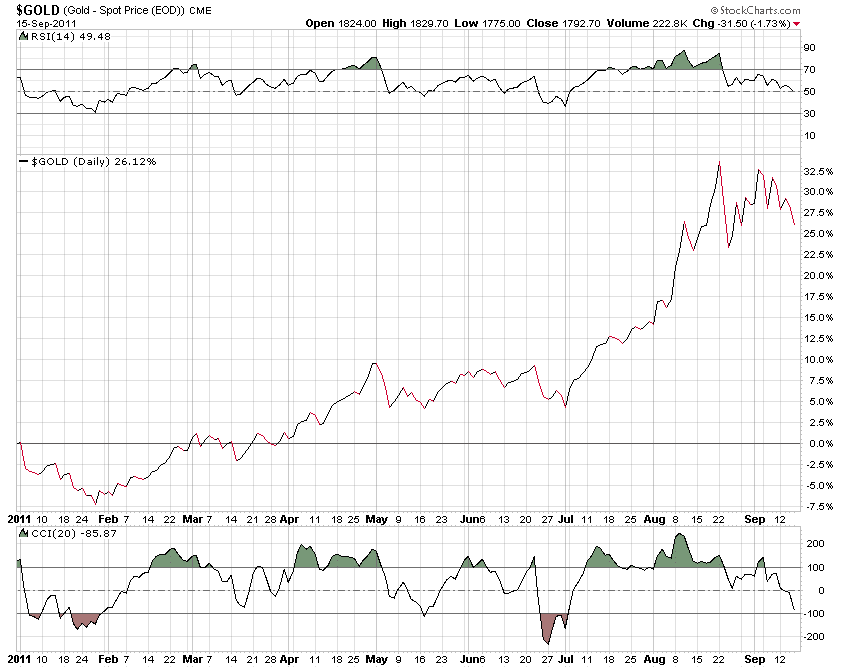

- Economic Uncertainty: With ongoing considerations about inflation, rising curiosity rates, and geopolitical tensions, many traders are turning to gold as a technique of preserving their wealth. The concern of market volatility has led to increased curiosity in tangible assets like gold.

- Elevated Consciousness: As more individuals develop into educated about the advantages of Gold IRAs, there has been a surge in inquiries and investments. Financial advisors are increasingly recommending Gold IRAs as a strategic element of a diversified retirement plan.

- Technological Advancements: The rise of online platforms and digital tools has made it easier for buyers to research, purchase, and handle their Gold IRA investments. Many custodians now supply consumer-friendly interfaces and academic assets to assist investors in navigating the process.

- Regulatory Changes: The IRS continues to update its laws regarding retirement accounts, together with Gold IRAs. Traders must stay informed about these changes to make sure compliance and maximize the benefits of their investments.

Considerations Before Investing in a Gold IRA

Whereas Gold IRAs supply a number of advantages, potential traders should consider the next:

- Charges and Costs: Gold IRAs typically come with numerous fees, together with setup charges, annual upkeep fees, and storage charges. It is important to grasp the overall cost of ownership earlier than committing to a Gold IRA.

- Market Volatility: While gold is generally thought of a stable asset, it is not immune to price fluctuations. Buyers must be ready for potential brief-term volatility and concentrate on long-term targets.

- Liquidity: Promoting bodily gold will be more complicated than liquidating traditional investments. Buyers ought to consider their liquidity wants and how simply they’ll convert their gold holdings into money if mandatory.

- Analysis and Schooling: As with any investment, thorough analysis and education are essential. Traders should familiarize themselves with the gold market, the precise metals they’re interested in, and the overall financial panorama.

Conclusion

Gold IRAs represent a unique opportunity for traders seeking to diversify their retirement portfolios and protect their wealth towards economic uncertainties. By understanding the advantages, processes, and current trends related to Gold IRAs, individuals can make knowledgeable decisions about their retirement savings strategies. Because the market continues to evolve, staying educated and conscious of changes in rules and investment options will be key to efficiently navigating the world of Gold IRAs. Whether or not you are a seasoned investor or new to the idea of treasured metallic investing, a Gold IRA may be a priceless addition to your retirement planning toolkit.